Our researchers, our ideas

In Münster, we use state-of-the-art methods to conduct research on the central issues of our time. Three examples from our research:

How do we create more innovations?

How should we tax large corporations?

What can we learn from data?

Get to know us. And welcome to Münster!

Professor Nadine Riedel

Regional Economics

Nadine Riedel is Professor of Economic Policy and Regional Economics. Prior to Münster, she was a professor at the University of Bochum, the University of Hohenheim, and a researcher at Oxford University. Her current research interests include issues related to the effects of taxation and the provision of local public goods and services on firm behavior. She is a member of the scientific advisory board of the German Federal Ministry of Finance.

Nadine Riedel teaches the courses "Economic Policy" and "Microeconometrics" in the Master of Economics.

Institute for Economic Policy and Regional Economics

Personal Website

Professor Martin Watzinger

Innovation & Entrepreneurship

Martin Watzinger is Professor of Innovation Economics and Entrepreneurship. Prior to his time in Münster, he had an temporary position as an academic councilor at the chair of Monika Schnitzer at LMU Munich. Visiting positions have taken him to Stanford, Harvard and Boston University. In his research, he investigates how we can increase innovation in Germany and worldwide, with a particular focus on science-based innovation.

Martin Watzinger teaches the courses "Fundamentals of Economic Policy" and "Game Theory" in the Bachelor of Economics and "Regulatory Economics" in the Master of Economics.

Chair of Innovation Economics and Entrepreneurship

Personal website

Professor Johannes Becker

Taxation & Globalization

Johannes Becker is Professor of Economics and Director of the Institute of Public Finance. After completing his doctorate in Cologne, he conducted research at the University of Oxford and the Max Planck Institute for Tax Law and Public Finance in Munich. He is an International Research Fellow at the CBT in Oxford. His research interests include public finance in a world of globalized markets, tax competition, and the taxation of multinational corporations.

Johannes Becker teaches the courses "General Taxation" in the Bachelor of Economics and "Microeconomics" and "International Public Economics" in the Master of Economics.

Institute of Public Economics l

Professor Markus Dertwinkel-Kalt

Behavioral and Digital Economics

Markus Dertwinkel-Kalt is professor of behavioral and digital economics. Before moving to Münster in 2022, he was Professor of Applied Microeconomics at the University of Konstanz and before that Junior Professor at the Frankfurt School of Finance and Management. In his research, he seeks to enhance our understanding of the impact of limited attention on economic decisions.

Markus Dertwinkel-Kalt teaches, among others, the courses "Digital Economics" in the Master VWL and "Behaviorial Economics" in the Bachelor VWL.

Chair of Behavioral and Digital Economics

Personal Website

Professor Aloys Prinz

Public Economics and Economics of Sports and Culture

Aloys Prinz is Professor of Public Economics. Before coming to Münster in 2000, he was Professor of Economic Policy at the University of Mainz.

His current research interests include public economics, in particular taxation and public debt. He also researches in the field of sports and cultural economics.

Aloys Prinz teaches, among others, the courses "Sport Economics" as well as "Financial Foundations of Tax Law" in the Bachelor VWL.

Institute of Public Economics II

Professor Gernot Sieg

Transport Economics

Gernot Sieg is professor of industrial economics, in particular infrastructure and transport economics, and director of the IVM (Institut für Verkehrswissenschaft Münster). Before joining WWU in 2013, he was a professor at TU Braunschweig and held teaching and research positions at the University of Southern California USC and the Free University of Bolzano. His current research interests include issues related to the organization and regulation of railroads, air travel, airports, and road transportation. He is a member of the Scientific Advisory Board of the Federal Ministry of Digital Affairs and Transport.

Gernot Sieg teaches, among others, courses on "Transport and Infrastructure Economics" and "Competition and Regulation" in the Bachelor and Master Economics.

Institute for Transportation Economics

Dr. Jörg Lingens

Energy and Climate Economics

Jörg Lingens is a substitute professor at the Chair of Microeconomics, esp. energy and resource economics. Before moving to WWU in 2007, Jörg Lingens held a temporary position as an Academic Councilor at the University of Regensburg. His research focuses on the effects of market imperfections and ways to address them.

Dr. Lingens teaches Industrial Economics, Energy Economics and Resource Economics in the Bachelor of Economics and Environmental Economics in the Master of Economics.

Chair of Energy and Resource Economics

Professor Bernd Kempa

International Trade

Bernd Kempa is director of the Institute of International Economics. After receiving his PhD from the University of Toronto in 1995, he was Professor of Macroeconomics at the European University Frankfurt (Oder) before being appointed to the University of Münster in 2008. His research interests international macroeconomics and monetary policy.

Bernd Kempa teaches, among others, the courses "Macroeconomics" as well as "International Macroeconomics" in the Bachelor and Master VWL..

Institute for International Economics

Professor Mark Trede

Econometrics

Mark Trede is Professor of Econometrics and Economic Statistics. Before being appointed to Münster in 2002, Mark Trede was a professor at the University of Magdeburg. His current research interests include data science, financial econometrics, and economic inequality.

Mark Trede teaches, among others, the courses "Statistics", "Econometrics" and "Data Science" in the Bachelor and Master Economics

Institute of Econometrics and Economic Statistics

Professor Bernd Wilfling

Empirical Economic Research & Financial Econometrics

Bernd Wilfling is Professor for Empirical Economic Research. Before coming to Münster in 2002, Bernd Wilfling conducted research at the Technical University of Dortmund and the University of Hamburg. His current research focuses on time series analysis, financial market econometrics, volatility modeling and forecasting, and the analysis of speculative asset price bubbles.

Bernd Wilfling teaches, among others, the courses "Statistics" as well as "Financial Econometrics" in the Master VWL.

Institute for Empirical Economics

Professor Ulrich Pfister

Economic History

Ulrich Pfister has been Professor of Social and Economic History since 1996. His research interests relate to the course and drivers of long-run economic growth. In this context, his group also undertakes research on the economics of populations, the behavior of commodity prices, and the long-term evolution of labor markets.

Ulrich Pfister and his group offer courses in the BSc and MSc elective modules on Quantitative Economic History.

Chair of Social and Economic History

Professor Thomas Apolte

Economic Policy Analysis

Thomas Apolte is Professor of Economics and holds the Chair of Economic Policy Analysis. Thomas Apolte has been a visiting scholar at Brigham Young University, George Mason University, West Virginia University, and Jagiellonian University in Krakow. His research interests are in public choice, political economy, and comparative economics, especially conflict economics and the economic theory of democracy and dictatorship.

Thomas Apolte teaches "Macroeconomics" in the Bachelor and "Advanced Public Choice" in the Master of Economics.

Center for Interdisciplinary Economic Research

Professor Martin Bohl

Monetary Economics

Martin T. Bohl is professor of monetary economics. Before joining the University of Münster in 2006, he was a professor at the European University Frankfurt (Oder). Martin T. Bohl has been a visiting scholar, at universities in Canada, Spain and France. His research interests are in the areas of monetary theory and policy, especially central bank communication, and price formation processes of commodity futures markets.

Martin Bohl teaches, among others, the courses "Microeconomics" as well as "Monetary Theory" and "Labor Economics" in the Bachelor and Master VWL.

Chair of Monetary Economics

Professor Christian Müller

Interdisciplinary Economic Research

Christian Müller is Professor of Economics and Economic Education at the Institute for Economic Education. Before his appointment to Münster in 2008, he completed his higher doctorate in economics in Duisburg-Essen and was a temporary professor for in social policy and social economics at the Ruhr University in Bochum. Müller has been a visiting scholar at the Workshop in Political Theory and Policy Analysis (Prof. Elinor Ostrom) at Indiana University Bloomington and at the Warsaw School of Economics, among others. He conducts research in the areas of economic education, public choice and constitutional political economy, and business and economic ethics.

Christian Müller teaches, among others, courses "Microeconomics" and "Business and Economic Ethics" in the Bachelor as well as in the Master of Education.

Center for Interdisciplinary Economic Research

Pictures of the professors © Winfried Michels

Our ideas

Our research deals with all subfields of economics. As examples, we would like to present three research topics here.

How do we create more innovations?

We live in times of amazing technological change. Many products that are commonplace today, such as airplanes, vaccines and robots, would have seemed like magic to our ancestors not so many generations ago.

At the Department of Economics in Münster, we conduct research on how technological progress occurs and how policy measures can increase it. Here is an example of recent work by our researchers in this area:

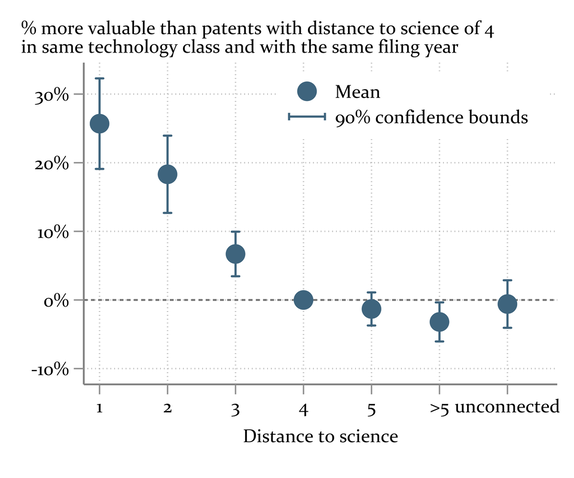

Research paper: "Standing on the shoulders of science"

Martin Watzinger (Münster), Monika Schnitzer (LMU München) und Joshua L. Krieger (Harvard University)

Abstract: Today's innovations rely on scientific discoveries of the past, yet only some corporate R&D builds directly on scientific output. We analyze U.S. patents to establish three new facts about the relationship between science and the value of inventions. First, we show that patents which build directly on science are on average 26% more valuable than patents in the same technology that are disconnected from science. Patents closer to science are also more likely to be in the tails of the value distribution (i.e., greater risk and greater reward). Based on patent text analysis, we next show that patent novelty predicts their value. Finally, we find that science-intensive patents are more novel. Overall, using science appears to help firms capture more value through relatively novel inventions.

Link to the article

Link to a summary on Harvard Working Knowledge

End of Researcher Section

How should we tax large corporations?

Multinational companies are of paramount importance to an economy. They pay higher salaries, are more innovative and contribute more to the value creation in an economy than purely national companies. However, many of these entrepreneurs pay only low taxes.

Our researchers in Münster are working on the question of how multinational companies can and should be taxed. An example of a recent paper by our researchers can be found here:

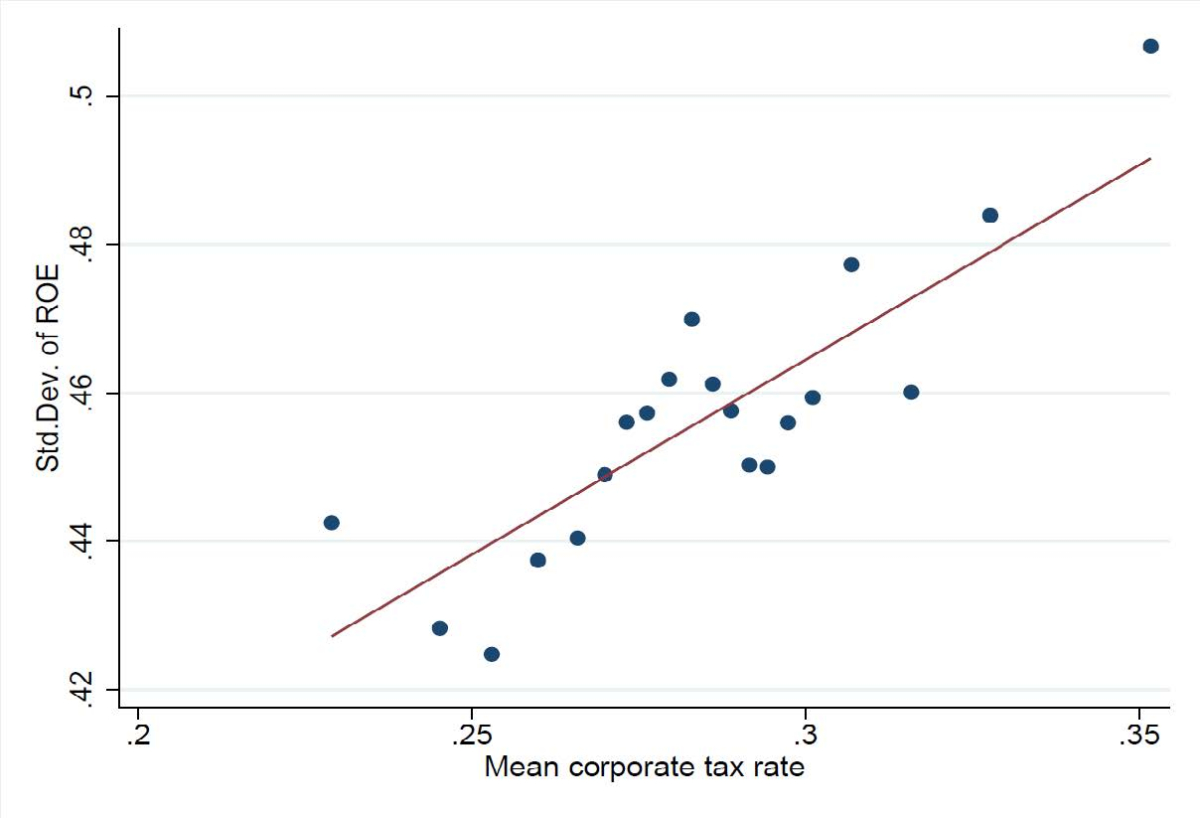

Research Paper: "Taxation and Risk Allocation in Multinational Corporations."

Johannes Becker (Münster), Nadine Riedel (Münster) und Nils Johannesen (Copenhagen Univ.)

Summary: This paper is the first to analyze both theoretically and empirically how taxation affects the joint allocation of risks and profits within a multinational firm. Theoretically, we identify three mechanisms through which corporate taxes can affect intra-firm risk allocation: (1) transfer pricing rules that require risks to be compensated for with higher expected returns create incentives to shift risks to low-tax countries in order to shift profits; (2) risk-averse owners create incentives to shift risks to high-tax firms in order to maximize risk sharing with the government; (3) limited loss relief creates incentives to shift risks to firms in other countries. Empirically, we show that multinationals disproportionately shift risks to low-tax countries and that the key mechanism is the link between risk and profit established by transfer pricing rules. Intra-firm risk differences explain a significant portion of the known correlation between profits and tax rates, suggesting that risk shifting is a quantitatively non-negligible channel of profit shifting.

Link to article

End of Researcher Section

What can we learn from data?

Economics does not take place in a theoretical vacuum and is always about the real world. To grasp it, we need data, for instance, from financial markets, on international trade flows, climate effects, social networks, on income and wealth distribution, and much more. Data Science provides tools to analyze this data, ranging from a simple description of the data through graphs and tables to modern, highly computer-intensive statistical econometric methods performed on high-performance computer clusters. An example of recent work by our researchers can be found here:

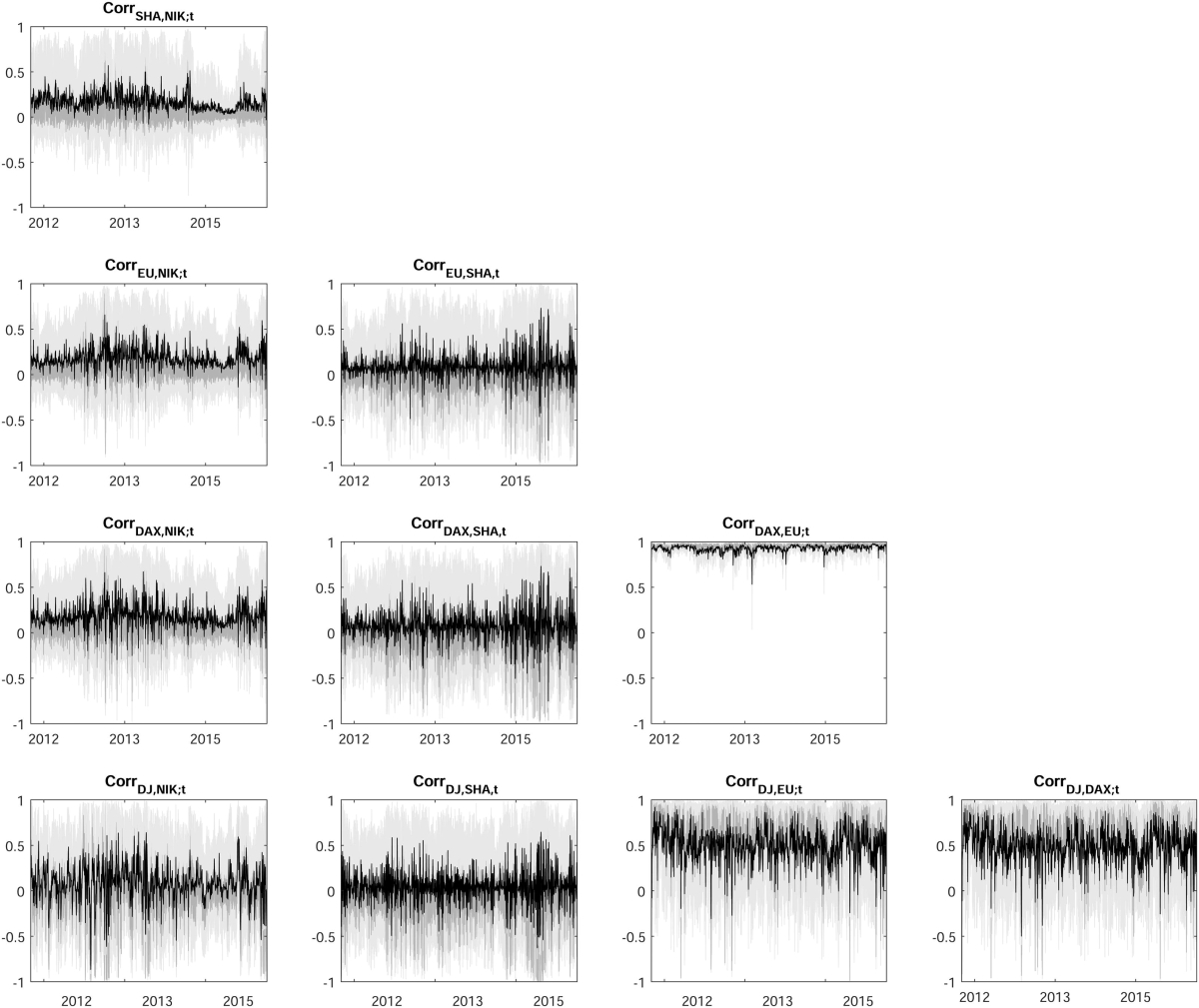

Research paper: "Bayesian semiparametric multivariate stochastic volatility with application".

Martina Danielova Zaharieva (CUNEF Madrid), Mark Trede (Münster) und Bernd Wilfling (Münster)

Summary: In this paper we establish a multivariate stochastic volatility estimation procedure of the Cholesky type in which we let the innovation vector follow a Dirichlet process mixture (DPM), which allows us to model highly flexible return distributions. The Cholesky decomposition enables parallel univariate process modeling and creates potential for estimating high-dimensional specifications. We use Markov chain Monte Carlo methods for posterior simulation and predictive density computation. We apply our framework to a five-dimensional dataset of stock returns, and analyze international stock market movements among the largest stock markets. The Empirical results show that our DPM modeling of the innovation vector achieves significant gains in out-of-sample density prediction accuracy compared to the prevailing benchmark models.

End of Ideas Section

Study with us!