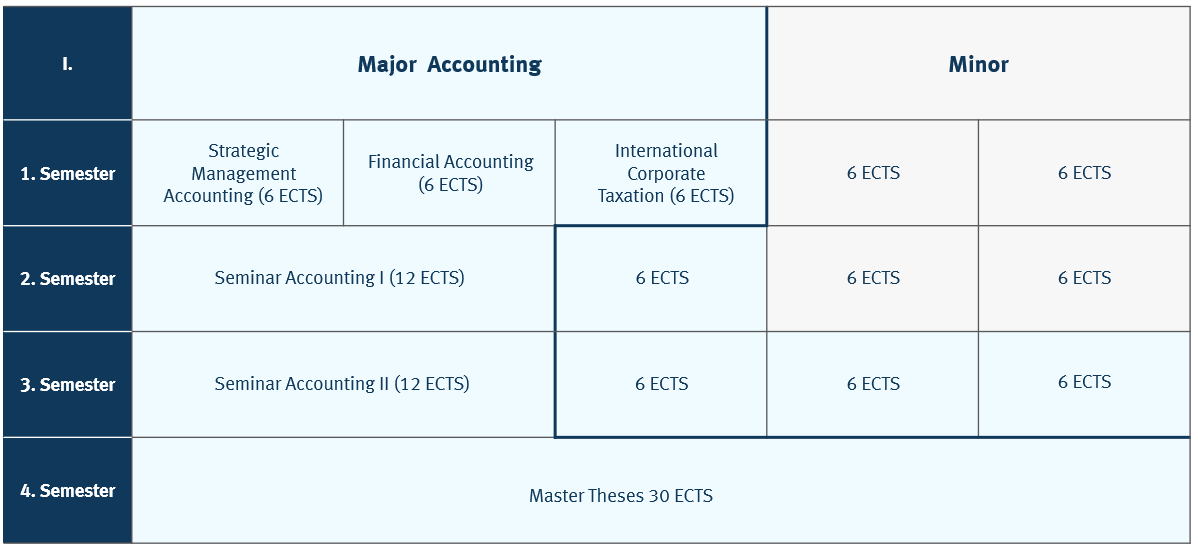

The following provides a detailed insight into the structure and content of the Master of Business Administration with a Major in Accounting. The standard period of study for the course is four semesters (full-time), with a required workload of 120 ECTS. Graduates are awarded the academic degree of Master of Science (M.Sc.).

Distribution of the 120 ECTS credits in the Master's degree program:

120 ECTS |

|

|---|---|

18 ECTS |

Foundation modules: The foundation modules deepen the knowledge acquired in the Bachelor's degree course and supplement this with specialized knowledge. This ensures that all students have a uniform and comprehensive level of knowledge at the start of the program. |

24 ECTS |

Seminar and project work: The seminar and project papers (ACM 5/6) offer students the opportunity to work intensively on a specific case over several weeks. The papers can be designed as literature-based or empirical studies as well as case studies. They serve as preparation for the Master's thesis and enable students to develop expertise in selected subject areas. |

18 ECTS |

Elective modules: Elective modules allow students to study certain subjects in greater depth and specialize individually, for example in performance management, international accounting, tax planning, auditing, and valuation. |

6 ECTS |

Free elective module: The free elective module (ACM 15) allows students to choose from a variety of courses from the Master's degree programs in Business Administration, Economics, Business Development and Information Systems. This interdisciplinary module option expands students' interdisciplinary knowledge and promotes an individual design of their studies. |

24 ECTS |

Modules from the minor: The major-minor structure of the Master's degree makes it possible to add one of the following eight minor subjects to the Accounting major:

The minor is selected at the beginning of the first semester. A change of the minor is permitted once, at the latest by the beginning of the second semester. |

30 ECTS |

Master Theses: Over a period of five months, the master's thesis involves an in-depth investigation of a specific research question. Depending on the topic, the thesis may take the form of a literature review, conceptual analysis, or empirical study. Upon agreement, theses may also be written in cooperation with a company, allowing students to address practical problems and facilitate knowledge transfer between theory and practice. |

|

|

||

|

ACM 1 | Strategic Management Accounting |

The module teaches concepts of strategic controlling that are used in the development and implementation of corporate strategies and focuses on the management perspective. This forms a basis for career-oriented activities in areas such as strategic controlling, management consulting and business development. For further information, please refer to the coursepage. |

|

ACM 2 | Financial Accounting |

The module provides an in-depth understanding of International Financial Reporting Standards (IFRS) and highlights their differences to national accounting systems such as Handelsgesetzbuch (HGB) as well as current developments in international accounting. A particular focus is placed on the regulations for the recognition and measurement of assets and liabilities as well as individual balance sheet items. Relevant aspects of consolidation are also covered. The aim of the module is to provide participants with comprehensive knowledge of IFRS so that they can critically analyze and evaluate IFRS financial statements and confidently apply practical accounting issues. For further information, please refer to the course page. |

|

ACM 3 | International Corporate Taxation |

The module deals with the practice of taxation of multinational companies as well as empirical tax research in this area. Important rules for the taxation of international companies are discussed, such as the avoidance of double taxation or the rules against the cross-border shifting of income (e.g. exit taxation, add-back taxation, transfer pricing). The starting point is international tax law. The basics of German tax law are also be taught. Furthermore, business research on the taxation of multinational companies is presented in excerpts. Students are taught how to use statistical software to create their own research papers. The aim is for students to gain an in-depth insight into the taxation of multinational companies, gain an initial overview of the relevant research literature and be able to carry out their own initial research projects on the taxation of international companies. For further information, please refer to the course page. |

|

ACM 6 | International Management Accounting and Control |

The module provides in-depth knowledge of controlling in international corporations and deals with both strategic and operational issues. Among other things, it focuses on the assessment of foreign investments and international relocations as well as budgeting, cost accounting and risk management. In addition, special national features of controlling and internal accounting are discussed in an international comparison. For further information, please refer to the course page. |

|

ACM 7 | Enterprise Analysis and Valuation |

On the one hand, the module teaches the basics of analyzing the economic situation of companies based on external accounting, with a focus on financial and performance analyses, key performance indicator systems and qualitative methods. On the other hand, company valuation is explained with a focus on overall valuation methods, in particular capitalized earnings value and DCF methods. For further information, please refer to the course page Enterprise Analysis course page Enterprise Valuation. |

|

ACM 8 | Corporate Strategy and Taxation I |

Two of the courses listed below can be taken as part of this module: The lecture “Umwandlungssteuerrecht” deals with the legal restructuring of companies through mergers, demergers, contributions and changes of legal form. The conditions under which such a process is tax-neutral are discussed. An exercise component is integrated. Previous tax knowledge is helpful, but a brief review of some particularly relevant topics is given at the beginning. For further information, please refer to the course page. The lecture “Steuerplanung” course with an integrated exercise component deals with the important area of tax-optimized structuring of circumstances. Examples are given of how the tax burden of a company can be reduced through decisions on legal form, financing, location, etc. In a theoretical part, aspects of corporate tax planning are first dealt with based on the Scholes-Wolfson paradigm, taking into account findings from the empirical literature, while in a second, practice-oriented part, specific tax structuring options are discussed. For further information, please refer to the course page. The lecture “Abgabenordnung” provides an insight into tax procedural law. The Fiscal Code contains, among other things, fundamental regulations on taxation procedures, extrajudicial legal remedies and criminal tax law that apply to all types of tax and can therefore be described as the core of German tax law. For further information, please refer to the course page. The lecture “Besteuerung der Vermögensnachfolge” deals with topics of inheritance and gift tax law. Inheritance and gift tax is an important substance tax characterized by a complex combination of material and personal elements. In addition, other tax regulations from the Income Tax Act are dealt with. For further information, please refer to the course page. The lecture“Steuerbilanzen” deals with the determination of taxable profit in accordance with the EStG, KStG and GewStG. The principles of profit determination and revenue surplus accounting are explained. The determination of taxable profit is linked to commercial accounting law; knowledge of HGB accounting is therefore desirable but not a prerequisite for participation. An exercise component is integrated. For further information, please refer to the course page. |

|

ACM 10 | Auditing |

This module deals with central aspects of auditing, including the economic foundations of auditing, the professional legal framework and the auditing process itself. Particular emphasis is placed on quality assurance and control of the audit against the background of current discussions on audit quality. The communication of the audit opinion in the form of the auditor's report and the audit report are also discussed. For further information, please refer to the course page. |

| ACM 11 | Financial Reporting I (winter term) |

The module provides students with in-depth knowledge of accounting under german commercial law, which is the relevant standard framework for the national annual and consolidated financial statements of non-capital market-oriented companies. The main focus is on recognition and measurement concepts under commercial law and accounting principles. For further information, please refer to the course page. |

|

ACM 13 | Performance Management and Strategy Execution |

This module deals with instruments for implementing corporate strategies and the orientation of managers and employees. The focus is on incentive and target systems, performance evaluation and management as well as the role of corporate culture. Learn about different management control systems and how they address different management problems as well as the underlying trade-offs of different management control systems in incentive design and organizational structure. For more information, please refer to the course page. |

|

ACM 14 | IFRS and Management Control |

The module deals with the interfaces between external and internal accounting, with a focus on their interrelationships and their significance for corporate management and publicity. The module provides a sound understanding of the role of controlling in financial reporting, the application of IFRS methods, the link between external and internal accounting and allows a critical assessment of harmonization in accounting. For more information, please refer to the course page. |

|

ACM 16 | Advanced International Financial Reporting |

The module covers advanced financial reporting issues for public and private companies, focusing on topics such as IFRS conversion, interim reporting, revenue recognition and IPOs. Rather than discussing accounting standards or balance sheet items in isolation, we conduct an integrated analysis of financial reporting issues based on real-world challenges that companies regularly face. The module is supplemented by an application-oriented case study. For more information, please refer to the course page. |

| ACM 17 | Corporate Strategy and Taxation II (summer term/ winter term) |

The sub-modules are identical to those from Corporate Strategy and Taxation I (ACM 8) and can be mutually credited and combined as desired. |

|

ACM 18 | From Data to Insights: Driving Corporate Performance |

The module teaches how data analysis can be used in corporate management to identify key performance indicators and improve management decisions. The aim is to develop analytical skills from a management perspective. A practical introduction to programming with Stata is given, with no prior knowledge required. At the end of the course, comprehensive knowledge of programming, statistics, teamwork and English terminology will be acquired. For further information, please refer to the course page. |

|

ACM 19 | Sustainability Accounting and Reporting |

The module provides an in-depth understanding of current developments in sustainability reporting. It deals with the new European Sustainability Reporting Standards (ESRS) and the IFRS Sustainability Disclosure Standards. In addition, the contents of sustainability-oriented corporate management and the analysis of sustainability reports are taught. A combination of lectures, integrated tutorials and practice-oriented guest lectures will provide insights into the application of these concepts. For further information, please refer to the course page. |

| ACM 20 | Financial Reporting II (summer term) |

The module deals with advanced topics of commercial and international accounting. These include, for example, long-term construction contracts, leasing, financial instruments and provisions. In addition, the focus is on current national and international regulations on group accounting and existing application issues. At the end of the course, comprehensive knowledge in the area of (inter-) national (group) accounting is acquired. For further information, please refer to the course page. |

Current issues in the field of accounting are presented and discussed in the ACM 9 and ACM 12 modules. The content of the courses varies depending on current developments. Exercises and case studies are integrated into the individual courses. Particular attention is paid to ensuring that the courses fit in with current research areas in accounting. Depending on the specific courses offered, the number and content of the courses may vary in individual semesters.

| Current topics in Accounting and Auditing I/II (summer term/ winter term) |

The lecture will discuss current accounting and auditing topics. The event will be held by WP Dr. Torsten Moser and WP/StB Dr. Daniel Siegel (board members of the Institut der Wirtschaftsprüfer in Deutschland e. V. (IDW)). For further information, please refer to the course page. |

|

Applied Business Analysis |

The course offers the opportunity to analyze various well-known companies in groups. The companies are analyzed on the basis of the annual reports and other publicly available information and the economic situation and development are assessed. The aim of the module is a practice-oriented transfer of knowledge on the analysis of annual/group financial statements with the relevant components known from the course “Balance Sheet Analysis” as well as an analysis of other financial reporting. For further information, please refer to the course page. |

| Empirical Accounting Research (summer term) |

The module provides an insight into empirical controlling and accounting research and familiarizes participants with the methods of empirical research. This should enable them to critically analyze scientific literature and successfully implement their own empirical research projects in the field of controlling or accounting (e.g. as part of their Master's thesis). To this end, the seminar also includes an application-oriented introduction to automated text analysis in Python, database work with LSEG Workspace and statistical data analysis with Stata. For further information, please refer to the course page. |

| Commercial and Corporate law I/II (summer term/ winter term) |

In commercial law, the special modalities of commercial law will be examined. In particular, the concept of a merchant, the commercial register, company law, commercial powers of attorney and the special features of commercial transactions will be examined. In the area of company law I, the GmbH and AG are introduced. The lecture Corporate Law II deals with the partnerships GbR, OHG and KG. The focus in each case is on representation and liability relationships. For further information, please refer to the course page Commercial and Corporate law I course page Corporate law II. |

|

John Molson Case Competition |

This module includes both the preparation for and participation in the prestigious John Molson MBA International Case Competition in Montreal, Canada. Every January, our team—comprising five master's students and two academic staff members—takes on the challenge of solving three-hour case studies daily over the course of a week and presenting their results to a panel of international top-level executives. This competition offers an excellent opportunity to develop practical case-solving skills, strengthen teamwork, and build an international network. Participants can earn up to 6 ECTS credits for their involvement. For more information, please refer to the course page. |

| Managing Growth: Organizational Design and Financial Management (summer term) |

Among other topics, this module explores how corporate management tools can be applied in young enterprises, how the business model influences managerial decision-making, and how organizational design can support sustainable growth. For more information, please refer to the course page. |

| Sustainability in Executive Decision Making (summer term) |

As part of the module, the regulatory framework for sustainability reporting is examined, and its impact on a company’s value chain is assessed. Starting with an overview of the regulatory landscape, the course covers: a) materiality analysis, b) implications for strategy development, c) implications for business planning, d) implications for the management information system (MIS), and e) implications for the work of the management board and supervisory board. Each of these topics is introduced with an overview, and the interdependencies between them are explored in depth. The course is conducted by WP/StB Prof. Dr. Gernot Hebestreit. For more information, please refer to the course page. |

| Business Simulation INTOP (summer term/ winter term) |

The INTOP business simulation aims to enhance understanding of the challenges faced by internationally operating companies. Participants, working in small groups, are required to demonstrate analytical thinking and conceptual creativity. They must organize themselves as a team and respond to dynamic complexity with structures that are capable of both action and adaptation. Each team manages an electrical engineering company at both the strategic and operational levels within a supply-side oligopoly and a demand-side structure resembling perfect competition. For more information, please refer to the course page. |

| Insurance Management (summer term) |

This course offers a unique and interdisciplinary insight into various areas of the insurance industry. Practice partners from LVM Versicherung and Provinzial Versicherung provide a comprehensive overview of different insurance products and segments, as well as the specific characteristics of the insurance business within the context of traditional corporate functions (e.g. human resources, controlling, accounting). For more information, please refer to the course page. |

If the Major Accounting and

For further information on the individual major and minor modules, please refer to the module handbook and the Master in Business Administration information page.