-

Chair of Derivatives und Financial Engineering

Our research mainly deals with the pricing of financial assets and their dynamics over time. We analyze stocks and stock indices but are also interested in equity options, index options, and variance derivatives. Equilibrium models explain asset prices based on the preferences of investors and the fundamental properties of the economy like aggregate consumption or production technologies. Option pricing models are our second research topic. We assess the predictions of these models and test for a consistent pricing of a cross section of stocks and options. We pay particular attention to the combination of theoretical models and empirical studies.

-

Chair of Sustainable Finance

In our research, we focus on two distinct themes: sustainability and asset price bubbles. As part of our sustainability research, we investigate individuals’ motives for socially responsible investing (SRI) and how these motives affect their investment decisions. From a corporate perspective, we analyze how differences in environmental and social standards across firms impact the financing and profitability of the firm. Our research on asset price bubbles concentrates on the empirical investigation of the causes and consequences of bubbles in financial markets. To understand the root causes of bubbles, we examine the performance of different investment strategies throughout the life cycle of bubbles. The analysis of the consequences of bubbles for the real economy completes our second research theme.

-

Chair of Finance

The Chair of Finance focusses on the reseach and teaching of the decision making behavior of financial market participants and their impact on the formation of prices in financial markets. One research focus is in the area of Behavioral Finance, which puts the assumption of a solely rational decision maker into question and substitutes it with a realistic decision making behavior, which is prone to error. Reseach projects of the chair often use empirical capital market data, one methodic focus is the experimental economic research. Within this reseach, methods and insights from psychology are used to get a better understanding of individual decision making and its impacts on capital markets. One textual focus of research is on the decision making behavior of private financial actors, especially in the context of retirement arrangements. The explicit goal is to generate findings for consumer protection and for the support of political decisions.

-

Chair of Banking

Our research focus is on the analysis of banks and other financial intermediaries. Above all, the existence of banks can be explained by asymmetrically distributed information, which is why the economies of information are of high importance for us. In addition, regulatory and tax requirements as well as accounting regulations, which are not always in line with economic considerations, indicate the relevance of the government. The scholarly and social significance of our thematic focus has often been demonstrated in the past. A prominent example in this context is the recent financial crisis, which has revealed numerous market imperfections. We consciously deal with a relatively broad range of topics from the areas of credit business, risk management, banking regulation, and internal and external accounting. Objectives include deriving the effects of given regulations, explaining observed phenomena, optimizing banking behaviour, and formulating policy proposals. We usually work quantitatively, i.e. with mathematical, statistical and econometric models and methods. We present the results of our work at national and international conferences and in leading scientific journals. In addition, we make our research results appropriately accessible to practitioners.

-

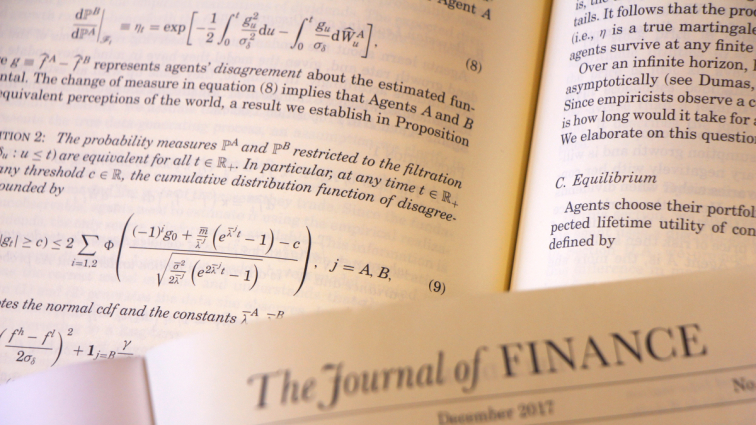

Professorship of Finance

The research focus of our group lies in the field of empirical corporate finance. That means, we quantitatively examine how companies behave in product, capital, and labor markets and analyze how this behavior affects the various stakeholders of a firm. In our analyses we pay special attention to the actions of top managers. Our research has been published in some of the most prestigious finance journals as the Journal of Finance, the Review of Finance, the Critical Finance Review and has won several prizes. Our main research interests are:

- Mergers and Acquisitions

- Labor and Finance

- Behavioral Corporate Finance

- Corporate Governance

- Financial Intermediation